The aim of the book is to help you shift focus from maximizing wealth to maximizing life experiences.

Apr 18, 2024

02:30 min read

Book Review: Die with Zero by Bill Perkins

Dean McClelland

Die with Zero: Getting All You Can from Your Money & Your Life by Bill Perkins

"Die with Zero" challenges the traditional approach to financial planning and retirement by emphasizing the importance of living life to its fullest and prioritizing memorable life experiences over accumulating wealth that will very often go unspent.

The core idea is to aim to have minimal or zero money left in the bank at the end of one's life.

Philosophy and Key Messages

The "Die with Zero" philosophy encourages individuals to shift their focus from maximizing wealth to living their best possible life. It emphasizes the idea that money is a resource that should be used to facilitate fulfilling life experiences, rather than being accumulated for the sake of accumulating wealth.

The book challenges the notion of delayed gratification, advocating for squeezing out more enjoyment from one's money and prioritizing lifelong memorable experiences over simply accumulating money for the so-called 'Golden Years'.

Financial Planning and Life Experiences

Bill's philosophy involves a deliberate and intentional approach to financial planning, where individuals determine the amount of money needed for the rest of their lives, aligning it with the experiences they want to have and ensuring that, according to life expectancy projections, they can expect to die with roughly zero dollars, i.e with no savings left unspent.

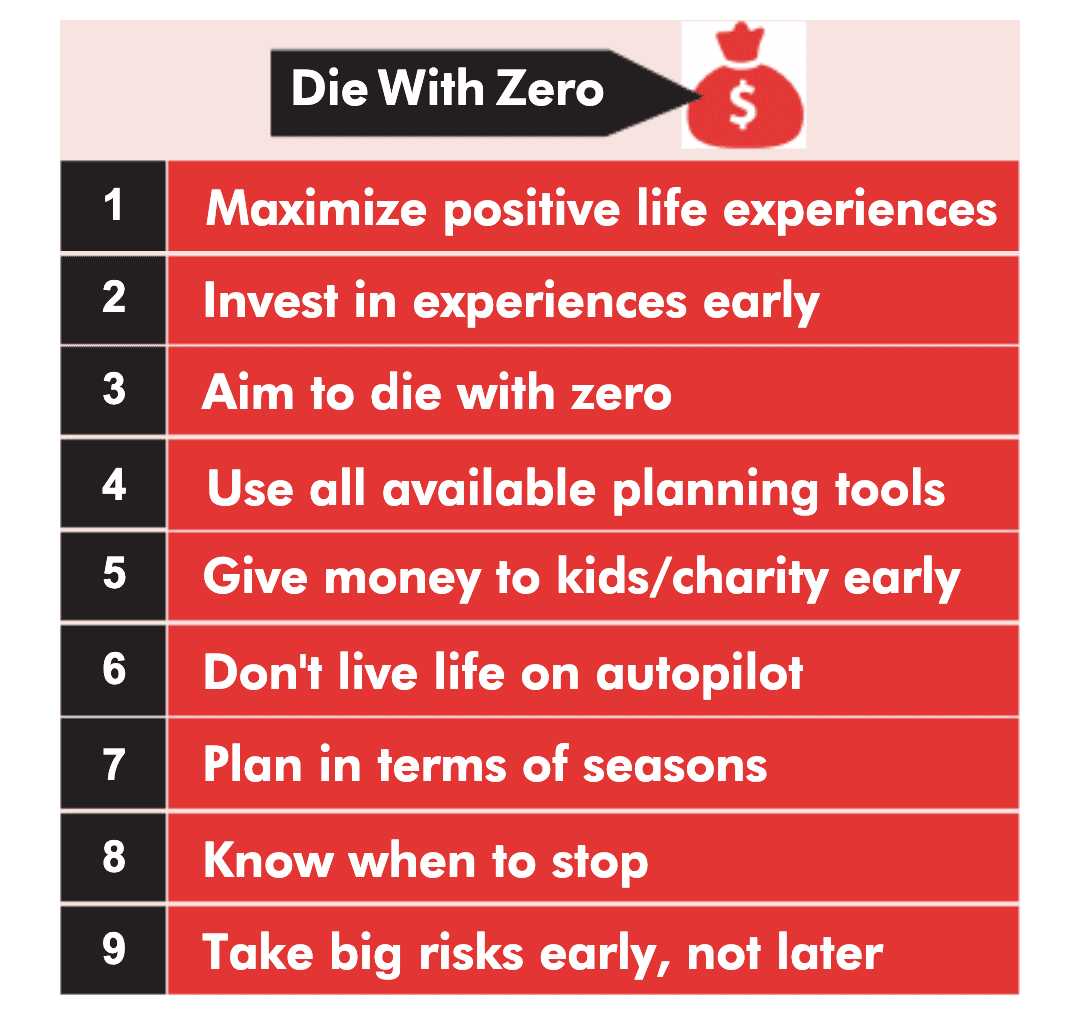

According to Summaries.com, the key tenets of the philosophy are:

Here at Tontine HQ we like this book a lot.

We are all about maximizing enjoyment in retirement and not a day goes by without us reminding people that 'when you're dead you don't need the money'.

There is a problem though. The whole philosophy revolves around planning your spending 'according to life expectancy projections'.

What you need to understand about life expectancy projections though is that they are averages.

In simple terms this means that nearly 50% of people are going to die earlier than expected and nearly 50% of people are going to die later than expected with only a very small percentage 'dying on time' with Zero.

So how can you safely maximize your spending on life experiences if you don't really know how long you are going to live for?

Well that's where a Tontine Trust comes in.

By contributing your retirement spending money into, for example, a TontineIRA™ you then maximize the amount you are spending every month without ever risking running out of spending money.

How? Well that's simple.

As explained above, nearly 50% of people will die too soon and have money left unspent and nearly 50% will live too long meaning that their savings will reach Zero way too early.

A Tontine solves this by redistributing the leftover monies of the died-too-young to those that have been blessed by a longer life and therefore need to avoid reaching Zero for potentially many more years to come.

In our minds, Die with Zero + a Tontine Trust = The best possible retirement.

Perhaps we can inspire Bill to write a sequel:

Die with Zero, but until then, Live like a Tontiner.

Find out more.

What Is a Tontine? Should You Invest In One?

Ruth Saldanha asks: Is a Tontine the Best Way to Get Income in Retirement?

Opinion: DoL must regulate IRA accounts

Kerry Pechter, author of Annuities for Dummies & editor of the RIJ explains why new rules on annuities are needed

Canada joins the global shift to tontine pensions.

Following on the heels of the OECD recommending that tontine pensions become mandatory, Canada is backing tontines